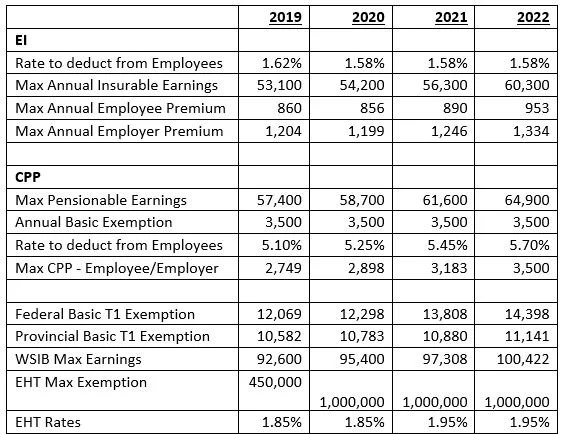

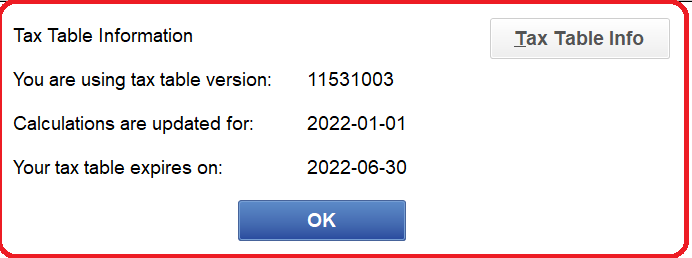

Payroll Tax tables are available - Effective from January 1, 2022 to June 30, 2022. - FinTech College of Business And Technology

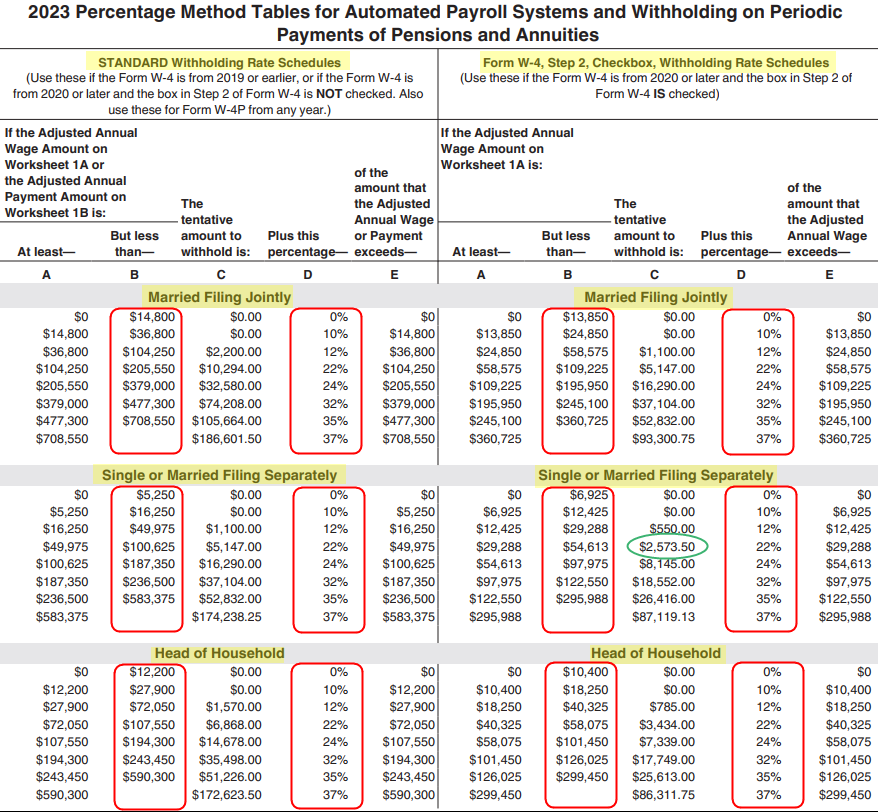

CHAPTER 4 QUIZ.docx - CHAPTER 4 QUIZ Sarah lives in Alberta and earns $693.45 per week. She also pays $12.00 per pay period for union dues and uses a | Course Hero

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)